With the Morrison Government projecting Australia’s largest ever budget deficits, it is clear that the COVID-19 pandemic has reshaped the economic and political landscape.

Central to this vastly changed environment is the expanded role government is now playing in our lives.

While the most visible aspects to date of this “bigger government” have been in the areas of health restrictions and income support, there are likely to be two more lasting changes.

Each of these present significant opportunities for industry, particularly for businesses who maintain strong relationships with government.

First, a near political consensus has emerged that supports significant deficit and debt to stimulate the economy.

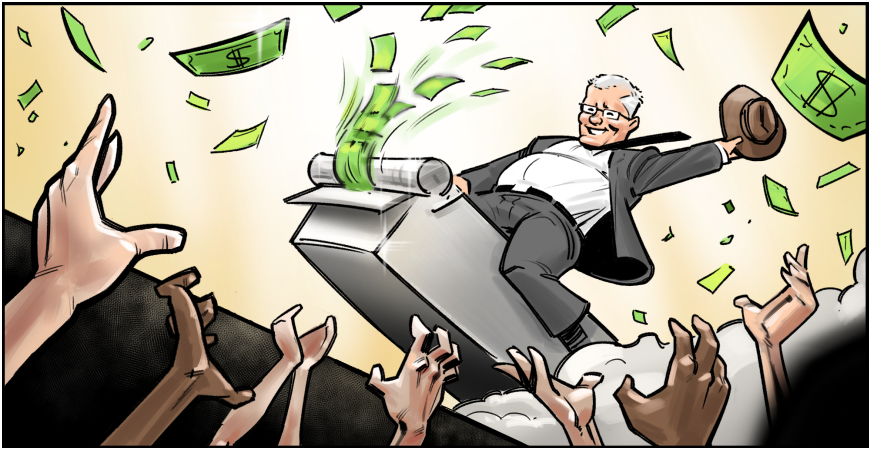

The traditional left has always supported deficit spending in times of recession, but the progressive left’s growing support for Modern Monetary Theory (MMT) takes this a step further. At its core, MMT holds that sovereign governments should spend in pursuit of full employment, only slowing down when inflationary pressures emerge. Budget deficits are seen as irrelevant, as sovereign governments, through their central banks, can create (print) as much money as they want.

Indeed, some argue that the Reserve Bank of Australia is already financing deficits and debt in Australia, with the RBA currently purchasing Commonwealth and state treasury bonds on the secondary market with “printed” money.

As we move to the right, support for stimulatory spending from government is linked to historically low interest rates. For decades, central banks have reduced interest rates when they have sought to stimulate the economy. Now, with this lever fully pulled, they have no room to move. And, with the cost of borrowing to governments effectively zero (negative, in some cases), there has never been a more affordable time for governments to borrow and stimulate.

What this consensus means for industry is more infrastructure projects going to market, more funds for industry development and R&D, more programs to stimulate exports, more programs to attract tourists, and so on.

The opportunities for businesses who stay close to government, help shape policy directions and respond to the directions set by government will be immense.

The second set of opportunities lie in the recognition by governments that they cannot do it alone. They need the support of industry to drive economic recovery, and they are keen to unlock the relatively strong balance sheets (compared to the post-GFC period) of corporates to do so.

This means going above and beyond to encourage private sector investment, whether that be through the streamlining of approvals processes, the encouragement of market-led proposals from industry or, dare I say it, picking winners through financial incentives.

There has never been a more prospective time for industry to be monitoring a rapidly changing regulatory environment for opportunities to progress projects that may have stalled. And there has never been a better time for industry to approach government with well-formed ideas to drive economic activity and job creation.

The COVID-19 crisis has been tough, if not devastating, for many businesses and the people they employ. But, with the focus of Australian governments shifting to economic recovery and their pockets deepening, there will be significant opportunities for many within industry, particularly those with strong relationships and a strong understanding of government.

With the role of government in our lives and economy set to remain enlarged for some time to come, now is the time for industry to tool up on their government relations functions, get ahead of the game and make the most of the opportunities the current economic crisis presents.

Given the size of the economic recovery task in front of us, the Morrison Government, and all of our state and territory governments, need us to.

ReGen Strategic

ReGen Strategic