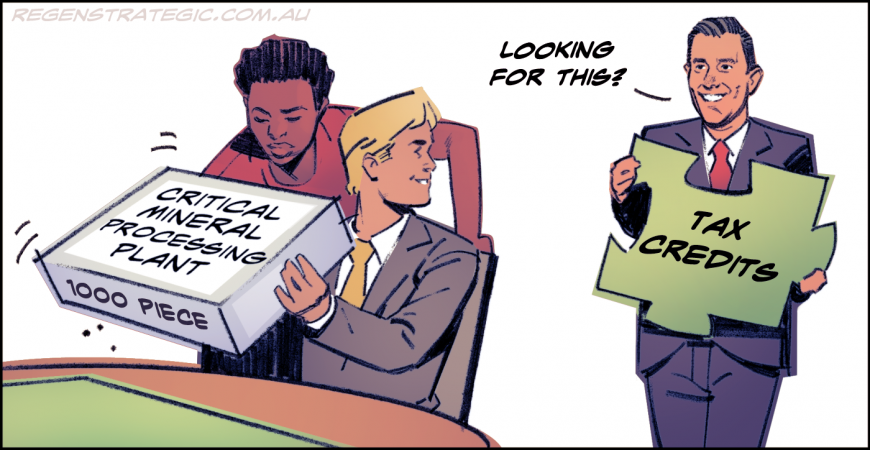

I can’t think of a good reason for the federal government not to bring forward the introduction of its proposed production tax credit for critical minerals processing. Not would it be good policy, it would also be good politics.

Critical minerals are essential to modern economies and technologies, from renewables and batteries through to missile guidance systems. They include several minerals abundant in Australia, including nickel, lithium and vanadium.

Proposed as a 10 per cent tax refundable offset on processing expenditure, the policy was announced in this year’s federal budget to help Australia compete for international investment. But, the measure is now seen as essential to the viability of some projects, as commodity prices fluctuate due to international market distortions.

To be eligible for support, projects must deliver first production between 1st July 2027 and 30th June 2040, but there are now loud calls from industry to bring the start date forward – a move the government will find hard to resist, given recent job losses in the sector, not to mention its strategic goal to secure as much of the critical minerals value chain in Australia as possible, to bolster both Australia’s economic resilience and national security.

And wouldn’t Peter Dutton’s opposition to the tax credits become a more effective weapon against him in Western Australia, if the opposition leader was promising to axe a policy designed to provide support sooner, rather than later.

This article also appeared on The West Australian newspaper.

ReGen Strategic

ReGen Strategic