Peter Dutton’s opposition to the Albanese Government’s production tax credits for critical minerals processing projects confuses me.

Mr Dutton talks up the security threat posed by China, yet appears untroubled by China processing most of the critical minerals the world needs for batteries and renewables.

He complains about the $7 billion cost of the credits. Yet, this is just a fraction of the going rate for the nuclear power plants he favours, if the latest $92 billion cost revision for the Hinkley C nuclear plant in the UK is representative.

Mr Dutton refers to production tax credits as corporate welfare, but taxpayer funds are regularly used to support strategic industries in the national interest.

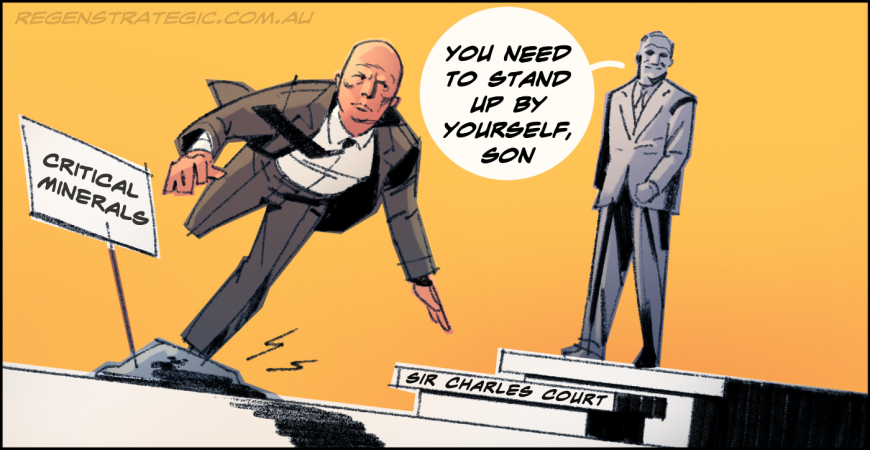

Would the visionary North West Shelf project have got off the ground without the government of Sir Charles Court underwriting it with 30 year take or pay contracts for domestic gas and financing the Dampier to Bunbury pipeline? Would new offshore gas projects go ahead, if taxed the same way as the onshore industry? Or our mining industry be anywhere near as successful without the diesel fuel rebate?

The only consistency I can find in Mr Dutton’s position is that it is the most recent of many instances where he has opposed a Labor initiative on climate change.

With other countries working hard to attract critical minerals investment, Mr Dutton’s approach threatens to leave Australia a dependent bit-player in a world that will decarbonise, with or without our help.

This article also appeared in The West Australian newspaper.

ReGen Strategic

ReGen Strategic