By Anthony Fisk

The Australian market for responsible investments has broken through the $1 trillion mark for the first time, with responsible investment assets growing at 15 times the rate of the market, according to a study released last week by the Responsible Investment Association Australasia (RIAA).

But the report warned that while many investment managers claimed to be practising responsible investing, only one quarter met RIAA’s definition of a “responsible investment leader”.

Meanwhile, a report released by Evergreen Consultants found that as many as 86 per cent of Australians now expect their superannuation and other investments to be held in funds that acted responsibly and ethically. Their data also found at least 10 per cent of funds that claim to have ESG [environmental, social, governance] orientation in their investments did not – a practice sometimes referred to as ‘greenwashing’.

As pressure increases on banks and investors to move towards higher standards of ESG investment practice, this too has an impact on businesses who are considered undesirable by the investment community.

Take for example, OnlyFans, a social network that says it was pressured by banking-service providers to ban explicit pornographic content. A recent move by Mastercard to suspend the website could have not only broken its business model, but also devastated the lives of the many ‘content creators’ who use the site for their only source of income.

The move has since been reversed, but it shows how powerful ESG investors can use their influence – in this case with payment firms – to confront their ties with ‘undesirable’ business activities.

Of course, there can be a disconnect with what the community views as undesirable and the attitudes of investment managers.

In the RIAA report, exclusion of the fossil fuel sector is front of mind for both the public and responsible investment managers, but issues don’t always align for other industries. For example, after fossil fuels, consumers seek products that screen for human rights and animal cruelty, while responsible investment managers exclude tobacco, porn, and the weapons industry.

CGM is helping our listed clients to consider the United Nations’ 17 Sustainable Development Goals as a framework for aligning their communications and reporting, as well as communicating how they’re integrating ESG risks into their decision making.

This communication has become increasingly important for companies as higher standards of reporting practices are demanded. For example, the release of a Global Sustainable Investment Alliance (GSIA) report in July found that industry standards were tightening to address the growing threat of greenwashing.

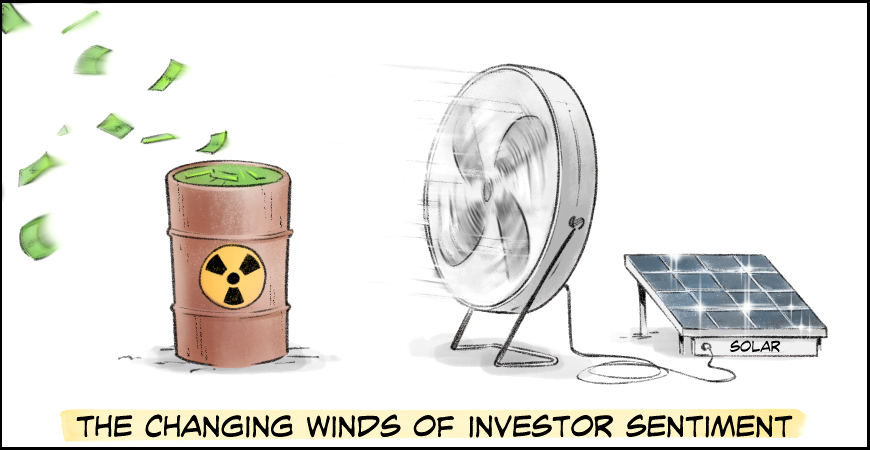

Of course, any good business should plan to get ahead of the changing winds of investor sentiment.

One of your first steps is getting a deeper understanding of your investors and what drives their investment decisions. But also working with the communities in which you operate to understand what is important to them, and ways your business can help communities thrive.

It is also critical to understand how ESG strategies impact the financial performance of your organisation. For example, the effects of the cost structure of raw materials in relation to extraction, procurement, transportation, energy use and social costs.

If possible, set clear and measurable objectives that both improve your business and are aligned to the ESG requirements of your stakeholders. Back up the commitments you make by regularly and publicly reporting on progress.

And continue to listen – public opinion can shift quickly!

With its ability to make or break businesses, it is foolish to ignore the rapid growth of the ESG sector.

With our knowledge of emerging issues and ability to communicate with investors, government, and community, CGM Communications can help you get ahead of the game.

ReGen Strategic

ReGen Strategic