The Insider/

Mandatory climate reporting: time to panic or prepare?

Australia’s long-anticipated sustainability reporting framework becomes active from 1 January 2025 for the first in-scope organisations.

To adhere to the new requirements of the Australian Sustainability Reporting Standard (ASRS) AASB S2, both large listed and private companies, as well as financial institutions, must evaluate and report on their climate-related risks and opportunities in a “Sustainability Report.”

In this first instalment of a new blog series, we’ll explore what this means and answer some of the most common questions about how best to prepare and why now is the time to take action, not panic!

What are the Australian Sustainability Reporting Standards (ASRS)?

The Australian Accounting Standards Board (AASB) issued the final ASRS on 20 September 2024.

The ASRS are a climate-first standard for assessing and disclosing information about an in-scope entity’s climate-related risks and opportunities. The standards are closely aligned to international standards, with modifications to suit Australia’s current legislation and regulations.

The first standard, AASB S1, is voluntary and covers sustainability-related financial disclosures, other than climate-related information.

The second standard, AASB S2 is mandatory and focuses on climate-related disclosures, aligning with international standards.

Who is an in-scope reporting entity?

The first step is to determine if your company is required to submit financial statements under Chapter 2M of the Corporations Act. This applies to:

- Large proprietary companies

- Listed companies that meet size thresholds

- NGER reporters (National Greenhouse and Energy Reporting), and

- Responsible Superannuation Entities or Managed Investment Schemes with $5 billion or more in assets under management

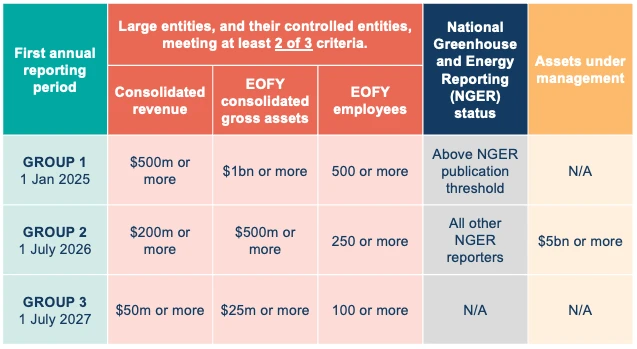

If you are one of the groups above, the next step is to understand whether you trigger any of the size thresholds as per the table below. This will determine which reporting group you fall into.

Should you focus only on AASB S2?

In-scope entities must report against AASB S2 and disclose their climate-related risks and opportunities, as well as how they will govern this process.

Some organisations will also voluntarily report against AASB S1 as this can help to increase overall sustainability maturity. By aligning to both AASB S1 and AASB S2, organisations will be better prepared if the Australian government decides to pass other mandatory sustainability reporting in future, for example on nature.

If I am not an in-scope entity, can I voluntarily report?

Yes, many organisations will voluntarily adopt the standards to provide a greater level of transparency and rigour to their sustainability practices.

Those organisations that voluntarily report will also be better prepared if they become an in-scope entity in the future or if stakeholders, including other in-scope entities, request data for their own reporting.

So, I am an in-scope entity, what do I need to report and when?

In-scope entities are required to prepare and submit a sustainability report as part of their annual financial reporting under the Corporations Act. The report will need to include:

- a climate statement for the year;

- notes to the climate statement;

- any statements required by a legislative instrument relating to matters concerning environmental sustainability; and

- a directors’ declaration.

The report is due to be submitted at the same time as the financial report.

What does the climate statement involve?

The climate statement needs to include:

- Governance and risk management processes, controls, and procedures;

- Climate resilience assessments underpinned by scenario analysis;

- Climate Transition Plans (CTP);

- Climate-related targets;

- Material climate-related risks and opportunities; and

- Specific metrics and targets, including Scope 1, Scope 2 and Scope 3 greenhouse gas emissions.

What is the director’s declaration?

The directors’ declaration is an essential component of the Sustainability Report.

This declaration affirms that the climate-related disclosures—such as the climate statement and accompanying notes—comply with the Corporations Act and AASB S2.

What are the penalties for non-compliance?

The penalties are like that of financial reporting penalties issued under the Corporations Act. However, there is a limited immunity period for certain information within the sustainability report for the first three years. Specifically, no action can be taken regarding Scope 3 emissions, scenario analysis, or transition plans for the financial years starting from January 2025.

That said, this immunity does not apply if the action is brought by the Australian Securities and Investments Commission (ASIC) or if the violation is criminal in nature.

What about Scope 3 emissions?

Scope 3 emissions reporting is required from the second reporting year. This covers indirect emissions related to your organisation’s value chain. Entities will need to consider and disclose which of the 15 categories in the GHG Protocol Corporate Value Chain are included in their reporting.

Time to prepare, not panic

While the implementation of mandatory climate-related reporting in Australia may seem daunting, it’s an opportunity to enhance your organisation’s sustainability practices, demonstrate transparency, and build resilience against climate risks. By starting early and preparing for compliance, you can position your business for long-term success in a rapidly evolving regulatory environment.

Whether you are in scope or voluntarily reporting, now is the time to take action, not panic. Start assessing your organisation’s climate risks, establish governance processes, and work towards transparent, actionable disclosures that will align with the new standards.

Stay tuned for the next instalment in this series where we’ll be covering how organisations can measure scope 3 emissions, especially if they have large supply chains.